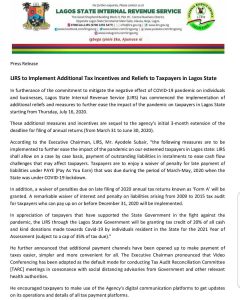

The Lagos State Internal Revenue Service (LIRS) issued a press released on July 15, 2020 in furtherance to her earlier public notice on the implementation of the Tax reliefs and Incentives and stated its commencement date to be July 16, 2020.

The Lagos State Internal Revenue Service (LIRS) issued a press released on July 15, 2020 in furtherance to her earlier public notice on the implementation of the Tax reliefs and Incentives and stated its commencement date to be July 16, 2020.LIRS reiterated the incentives stated in the public notice which are listed below:

• Waiver of Penalty for late payment of liabilities under PAYE that were due during the period when the State was under lockdown (March-May 2020)• Waiver of Penalties due on late filling of 2020 Annual Tax returns (Form A)

• Waiver of interest and penalty component of outstanding tax audit liabilities from 2009-2015 for entities that present and keep to a structured payment plan that terminates on or before December 31, 2020

• Grant of tax credit of 20% of cash and kind donation made to Covid -19 by resident individuals to LASG for the year 2021 Year of Assessment only subject to a cap of 35% of tax due.

All tax payers including Corporate organization can take the advantage of the incentives subject to the condition stated in the public notice;

I. Waiver of Penalty for late payment of liabilities under PAYE that were due during the period when the State was under lockdown (March-May 2020): PAYMENT OF THE MARCH – MAY TAX REMITTANCE

II. Waiver of Penalties due on late filling of 2020 annual Tax returns (Form A): FILLING OF 2020 ANNUAL TAX RETURNS (FORM A)

III. Waiver of interest and penalty component of outstanding tax audit liabilities from 2009-2015 for entities that present and keep to a structured payment plan that terminates on or before December 31, 2020: PAYMENT OF ALL OUTSTANDING 2009-2015 TAX LIABILITIES UP ON OR BEFORE DECEMBER 31, 2020

IV. Grant of tax credit of 20% of cash and kind donation made to Covid -19 by resident individuals to LASG for the year 2021 Year of Assessment only subject to a cap of 35% of tax due: MAKING DONATION IN CASH AND KIND TO COVID – 19 AND MUST NOT EXCEED 35% OF THE TAX FOR THE YEAR 2020 YEAR OF ASSESSMENT.

For further enquires kindly visit www.ijewere.net or contact 08129929306 08129929442

Good one.Thank you for the info